What are business rates?

Business rates (also called non-domestic rates) are a tax charged on most commercial properties, such as shops, offices, pubs, and warehouses. If you use a building or part of a building for business purposes, you’ll likely need to pay business rates.

Why do we pay business rates?

A proportion of business rates help fund local services—just like council tax does for residential properties. The money collected directly supports businesses such as local infrastructure, the police and fire brigade. While indirectly supports the funding of education, housing and street cleaning. A large proportion goes to central Government and to the Greater London Authority.

Who pays business rates?

You’ll need to pay business rates if you occupy a non-domestic property. If a property is empty, the owner or leaseholder is usually responsible for the rates.

Some businesses are not rateable including farm buildings, public places of religious worship or places used for the welfare of disabled people.

How are business rates calculated?

Your bill is based on your property’s rateable value, which is set by the Valuation Office Agency (VOA). This value reflects the estimated annual rent your property could earn on the open market.

The council multiplies the rateable value by a multiplier (set by the government) to calculate your bill. You can check your property’s rateable value on the VOA website and appeal the value shown in the list if you believe it is wrong.

Rating Advisers

You do not need to be represented when discussing your property's rateable value or your business rates bill. However, if you choose to appoint a representative, it's important to ensure they are properly qualified.

Members of the Royal Institution of Chartered Surveyors (RICS) and the Institute of Revenues, Rating and Valuation (IRRV) are professionally accredited and follow strict codes of conduct designed to protect clients from misconduct.

Before hiring a rating adviser or company, check that they have:

- Relevant knowledge and experience

- Appropriate professional indemnity insurance

Take care when entering into any agreement, and seek independent advice if you're unsure.

Your business rates bill explained

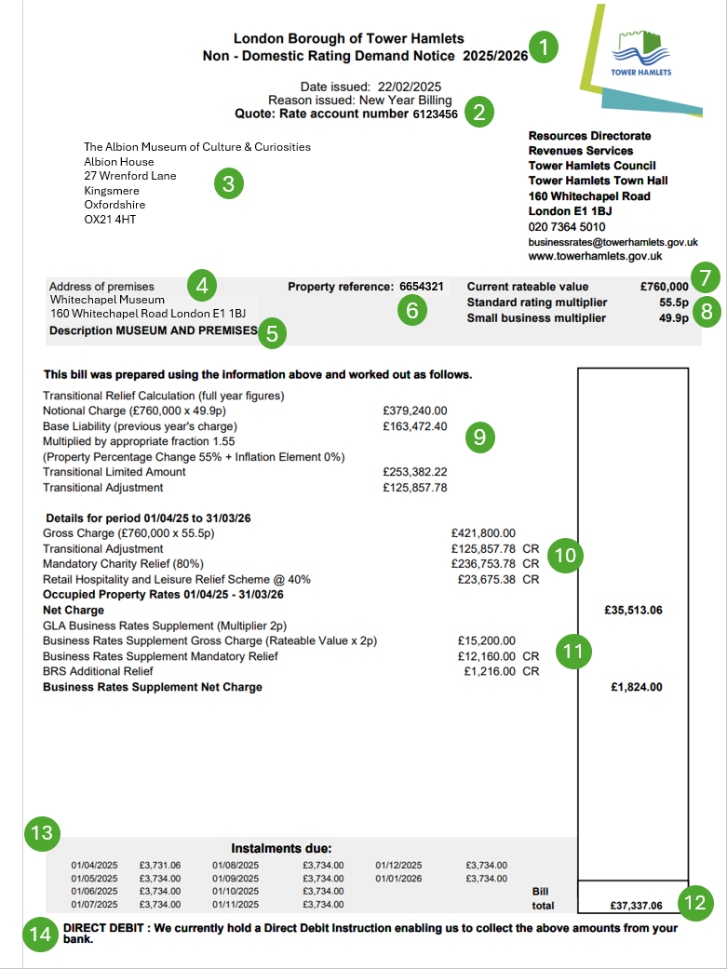

This is an example of a Business Rates bill. The charges and reliefs shown may vary depending on individual circumstances and are provided here as a general guide only.

- Billing Year – This shows the financial year the bill covers. Business Rates are charged by tax year, which runs from 1 April to 31 March and spans two calendar years.

- Business Rates Account Number – You’ll need this number when contacting us or making a payment.

- Account Holder Details – The name and address of the person or company responsible for the charge.

- Property Address – The business property the charge applies to.

- Property Description – A brief description of the property type, as listed by the Valuation Office Agency (VOA).

- Property Reference Number – A unique identifier for the property.

- Rateable Value – Set by the VOA, this is not the amount you pay but is used to calculate your bill.

- Multiplier – The Government sets two multipliers each year:

- The standard multiplier applies if your rateable value is £51,000 or more.

- The small business multiplier applies if your rateable value is below £51,000.

- Transitional Relief – If your bill has changed significantly due to revaluation, transitional relief may apply. This limits how much your bill can increase or decrease each year. It’s applied automatically if you’re eligible.

- Gross Charge and Reliefs – The gross charge is calculated by multiplying the rateable value by the appropriate multiplier and dividing by 100. Any reliefs (e.g. Transitional, Charitable, or Retail, Hospitality and Leisure Relief) are then deducted. You can learn more on our Business Rates Reductions page.

- Business Rate Supplement (BRS) – The Greater London Authority (GLA) applies a BRS to properties with a rateable value over £75,000 to help fund the Crossrail project. It’s charged at 2p per £1 of rateable value.

- Amount Payable – This is the total amount due for the billing period.

- Instalment Dates – These are the dates your payments are due. Click here if you’d like to change your instalment schedule.

- Direct Debit – If you’ve set up a Direct Debit, it will be shown here. It’s the easiest way to pay. Set up a direct debit.

Information Supplied with Demand Notices

Information relating to the relevant and previous financial years regarding the gross expenditure of the local authority.

Read the explanatory notes for more information.

Data Protection

Any information you provide will be used solely for administering your business rates. All data is stored securely and processed in accordance with the Data Protection Act 1998 and the General Data Protection Regulation (GDPR).

The Council has a legal duty to protect public funds and may use your information to prevent and detect fraud, as well as for other lawful purposes. This may include matching business rates data with other council records.

We may also use your information to carry out statutory enforcement duties and will disclose data only when required by law. Basic business rates information (such as your name and address) may be used across council services to:

- Help you access services more easily

- Improve service efficiency

- Recover money owed to the Council

We will never share your personal information with third parties for marketing purposes.

For more details, please refer to our Legal Notices page.