What do you use my council tax for?

Council Tax is the contribution that people who live in Tower Hamlets make to the many services provided by the borough, such as street lighting, collecting rubbish, schools and libraries, as well as the police and fire service.

The council is required by law to collect money for other organisations through the council tax.

These organisations are the Greater London Authority (GLA), the Environment agency, London Pension Fund Authority and the Lee Valley Regional Park Authority.

The council cannot influence how much they charge.

The Mayor of London has increased the Greater London Authority (GLA) element of Council Tax by 4%, a Band D increase of £18.98.

The increase to Council Tax bills for a Band D property is £79.06. The 2.99% rise in the council’s element of Council Tax will be offset for many households by a new Council Tax Cost of Living Relief Fund. Any household with an income of less than £50,350 will be able to apply for relief.

How is council tax going to be spent this year?

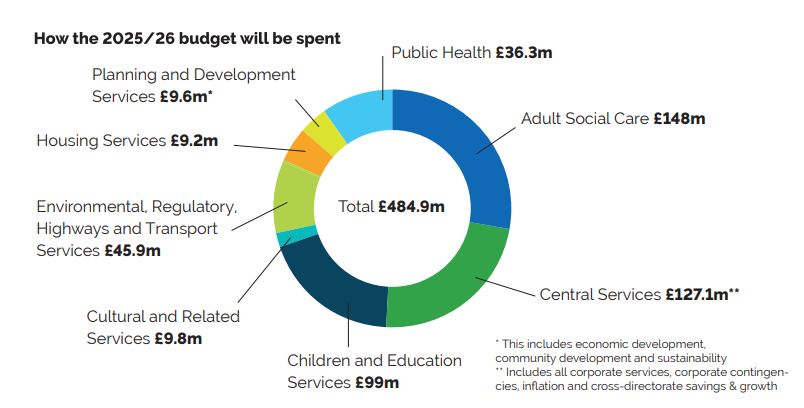

The council’s net expenditure in 2025-26 will be £484.9m, which includes income generated through rents, investments and charges for services.

The total net expenditure is funded through retained business rates, council tax, reserves and specific grants.

Budgeted net expenditure 2025/26

| Adult Social Care |

£148m |

| Central Services** |

£127.1m |

| Children and Education Services |

£99m |

| Cultural and Related Services |

£9.8m |

| Environmental, Regulatory, Highways and Transport Services |

£45.9m |

| Housing Services |

£9.2m |

| Planning and Development Services* |

£9.6m |

| Public Health |

£36.3m |

*This includes economic development, community development and sustainability

** Includes all corporate services and corporate contingencies

In addition, the council pays for school services which are fully-funded by government grants that are restricted to these particular services.

Further information

There is a thorough breakdown of how your council tax contributes to making Tower Hamlets a great place to live in the Council Tax booklet.

For more information bands/guidance to accompany your Council Tax demand note (bill).